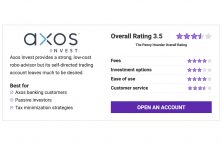

Axos Financial rebranded WiseBanyan as Axos Invest in October 2019.

Building on its managed portfolios platform, Axos Invest launched self-directed trading accounts in 2021.

Managed Portfolios is Axos robo-advisor option.

Want to see how Axos compares to other robo-advisors? Check out our review of thebest robo-advisor apps.

It creates a diversified portfolio for you based on your risk tolerance and financial goals.

It also gives you the option to tweak investments inside your portfolio if you disagree with the computer algorithm.

Probably not as good as youd like.

It always seems like an uphill battle to build (and keep) a decent amount in savings.

But what if your car breaks down, or you have a sudden medical bill?

Ask one of these companies to help…

If youre a hands-on investor comfortable placing your own trades, Axos Invest also offers self-directed accounts.

Theres no annual advisory fees or account minimums for self-directed accounts.

Youll start by answering a few questions about your risk tolerance, income and financial goals.

you could set multiple goals within the app.

you could save toward major life events like retirement, a new home, a wedding and more.

it’s possible for you to also adjust and change your goals over time.

Axos Invest is unique because its Managed Portfolios allow more customization than many other robo-advisors.

you’re able to build Custom Portfolios or select from a handful of pre-built Featured Portfolios.

Axos Invest charges an annual 0.24% advisory fee on your investment portfolio balance.

This is nearly identical to other robo-advisors, likeWealthfrontandBetterment, which both charge 0.25% advisory fees.

Because they hold multiple securities in a single share, they help provide instant diversification to your portfolio.

Instead of hand-picking numerous stocks or bonds, an ETF bundles the biggest companies together into a single fund.

Automatic Rebalancing

Axos Invest users get free automatic rebalancing on all managed investment portfolios.

Axos will rebalance your investment portfolio when your asset allocation drifts 5% or more from its target allocation.

Rebalancing means the company adjusts the securities in your portfolio so they match the allocation you originally selected.

The goal is to use some of these losses to offset the cost of capital gains tax.

Axos Invest offers other tax minimization strategies, including selective trading.

Quick Deposit and Auto-Deposit Scheduler

Some investment apps take one to three days to process your deposits.

Axos Invests quick deposit feature lets you invest any deposits on the same day or the next trading day.

The companys auto-deposit scheduler lets you pick the specific day new funds are deposited into your account.

These accounts dont provide automatization or guidance like a robo-advisor.

Theyre best suited for active traders who know their way around the stock market.

The account offerings for Managed Portfolios and self-directed accounts are similar.

Self-directed traders can access joint brokerage accounts.

You cant purchase fractional shares with a self-directed account either.

Account Minimum and Fees

Theres no required minimum deposit to open an Axos Invest self-directed account.

However, youll need a $50 minimum investment to open a self-directed IRA.

(Many other online brokers offer IRAs with no account minimum.)

Axos Invest offers $0 commission-free trading on stocks and ETFs.

This is standard for most trading platforms nowadays.

The company also lacks low-cost mutual funds, which generally carry fund fees less than 0.5%.

Instead of paying $1 per contract on options trades, Elite users pay $0.80.

Axos Elite users can also apply for margin trading.

Margin trading is a risky endeavor because you could lose much more than you invested.

Its best reserved for professional money managers and sophisticated investors.

But if youre determined to trade on margin, Axos Elite charges an interest rate of 5.5%.

In our opinion, Axos Elite comes at a premium price without worthwhile premium benefits.

Instead, new users must sign-up on the Axos Invest website.

After that, you might download the Axos Bank app and login with your Axos Invest username and password.

You dont need to open an Axos checking or savings account to use the mobile app.

Once youre logged into the app, its easy to manage your investing account.

But the app isnt perfect.

You cant purchase mutual funds for your self-directed account in the app, for example.

But the platform doesnt include robust educational videos, interactive tools or other features helpful to new investors.

Axos Invest also lacks discussion forums, tutorials and seminars.

Access to Human Advisors

Axos Invest doesnt offer access to human financial advisors.

If youre looking for 1-on-1 personalized investment advice, look elsewhere.

Axos Banking Services

Axos Invest accounts dont offer a savings account or cash management option.

However, you’re able to open a savings account with Axos Bank, its affiliate company.

However, we would be remiss not to mention some complaints we found online about the investing platform.

Many involved issues with transferring assets to a new brokerage firm and receiving cost basis information.

Others complained of slow response times from Axos.

Pros and Cons

Like all investing platforms, Axos Invest has its ups and downs.

Heres what we like and dislike about the companys robo-advisor and self-directed trading platforms.

We think its the companys strongest option.

Heres where this platform shines, and where it can use some work.

Pros and Cons About Self-Directed Portfolios

Axos Self-Directed Tradingaccount honestly leaves a lot to be desired.

Since the company just launched self-directed accounts in 2021, we hope its features and offerings improve over time.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.

No Interest Til Almost 2027?

Balance Transfer = Credit Card Cheat Code